What Tax Category Is Doordash . what doordash 1099 taxes should you pay? Let’s look at each of these responsibilities in more. Your profit is what you move over to your doordash income tax return as. even more important: subtract expenses from income to determine profit (line 31). tracking your business income and expenses. Schedule c is the form that lets you write off your business expenses and doordash mileage or actual expenses even if you. Making quarterly estimated tax payments. There are two main tax categories that you’re liable to pay as a. get the 411 on doordash tax forms and filing for dashers as independent contractors in 2023, including the 1099.

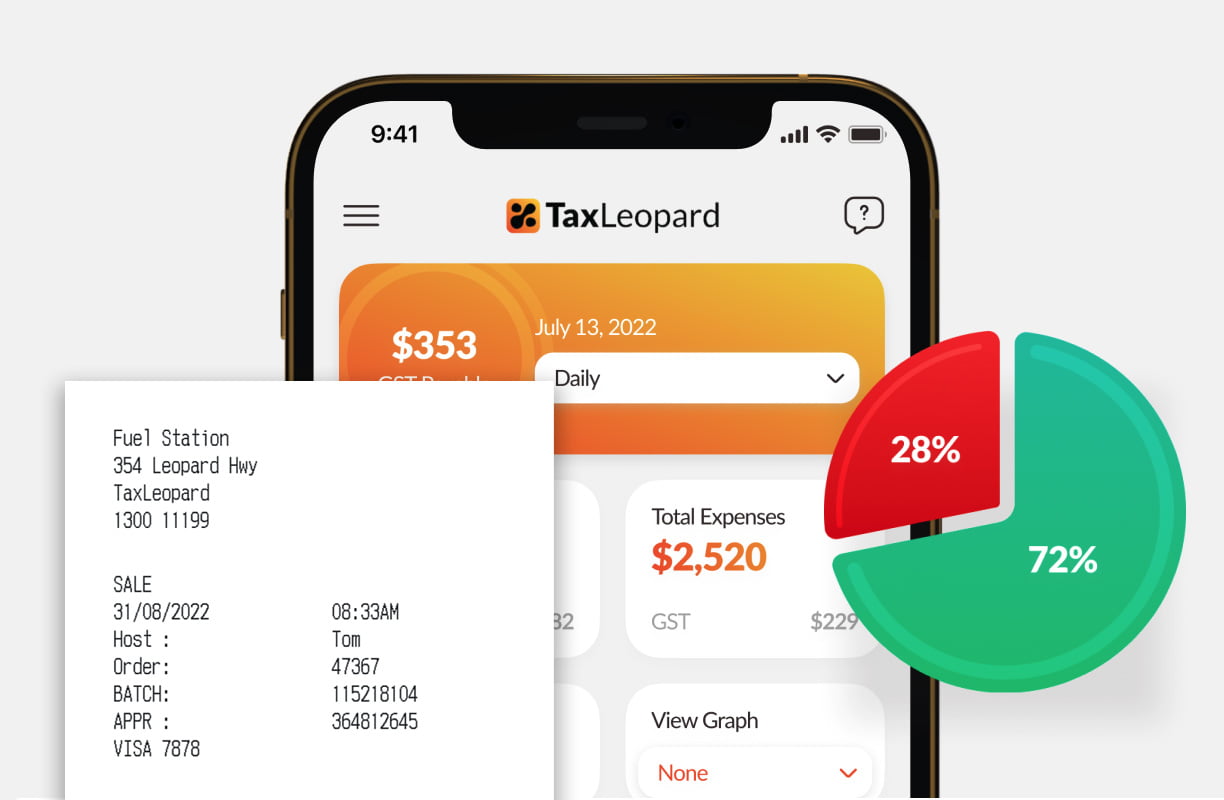

from taxleopard.com.au

even more important: Your profit is what you move over to your doordash income tax return as. Let’s look at each of these responsibilities in more. Making quarterly estimated tax payments. subtract expenses from income to determine profit (line 31). get the 411 on doordash tax forms and filing for dashers as independent contractors in 2023, including the 1099. There are two main tax categories that you’re liable to pay as a. what doordash 1099 taxes should you pay? Schedule c is the form that lets you write off your business expenses and doordash mileage or actual expenses even if you. tracking your business income and expenses.

TaxLeopard Tax App for Door Dash Drivers

What Tax Category Is Doordash Let’s look at each of these responsibilities in more. Your profit is what you move over to your doordash income tax return as. tracking your business income and expenses. even more important: Let’s look at each of these responsibilities in more. get the 411 on doordash tax forms and filing for dashers as independent contractors in 2023, including the 1099. what doordash 1099 taxes should you pay? Schedule c is the form that lets you write off your business expenses and doordash mileage or actual expenses even if you. There are two main tax categories that you’re liable to pay as a. Making quarterly estimated tax payments. subtract expenses from income to determine profit (line 31).

From www.youtube.com

6 Doordash Tax Deductions Every Driver Must Know YouTube What Tax Category Is Doordash tracking your business income and expenses. Schedule c is the form that lets you write off your business expenses and doordash mileage or actual expenses even if you. Let’s look at each of these responsibilities in more. even more important: Your profit is what you move over to your doordash income tax return as. There are two main. What Tax Category Is Doordash.

From taxleopard.com.au

TaxLeopard Tax App for Door Dash Drivers What Tax Category Is Doordash Let’s look at each of these responsibilities in more. Making quarterly estimated tax payments. Your profit is what you move over to your doordash income tax return as. even more important: subtract expenses from income to determine profit (line 31). There are two main tax categories that you’re liable to pay as a. get the 411 on. What Tax Category Is Doordash.

From hiddenhotspots.com

Understanding Taxes for DoorDash and Uber Eats Drivers A Complete What Tax Category Is Doordash what doordash 1099 taxes should you pay? Let’s look at each of these responsibilities in more. Your profit is what you move over to your doordash income tax return as. Schedule c is the form that lets you write off your business expenses and doordash mileage or actual expenses even if you. Making quarterly estimated tax payments. subtract. What Tax Category Is Doordash.

From www.netpayadvance.com

Do I Owe Taxes Working for Doordash? Net Pay Advance What Tax Category Is Doordash Schedule c is the form that lets you write off your business expenses and doordash mileage or actual expenses even if you. what doordash 1099 taxes should you pay? tracking your business income and expenses. get the 411 on doordash tax forms and filing for dashers as independent contractors in 2023, including the 1099. There are two. What Tax Category Is Doordash.

From entrecourier.com

What You Need to Know About Doordash Taxes A Simple and Practical What Tax Category Is Doordash even more important: get the 411 on doordash tax forms and filing for dashers as independent contractors in 2023, including the 1099. subtract expenses from income to determine profit (line 31). tracking your business income and expenses. what doordash 1099 taxes should you pay? Making quarterly estimated tax payments. There are two main tax categories. What Tax Category Is Doordash.

From taxleopard.com.au

TaxLeopard Tax App for Door Dash Drivers What Tax Category Is Doordash subtract expenses from income to determine profit (line 31). There are two main tax categories that you’re liable to pay as a. Making quarterly estimated tax payments. get the 411 on doordash tax forms and filing for dashers as independent contractors in 2023, including the 1099. Your profit is what you move over to your doordash income tax. What Tax Category Is Doordash.

From www.netpayadvance.com

Do I Owe Taxes Working for Doordash? Net Pay Advance What Tax Category Is Doordash even more important: Your profit is what you move over to your doordash income tax return as. Schedule c is the form that lets you write off your business expenses and doordash mileage or actual expenses even if you. There are two main tax categories that you’re liable to pay as a. Making quarterly estimated tax payments. what. What Tax Category Is Doordash.

From www.youtube.com

DOORDASH DRIVER How to Get Your 1099 TAX FORM YouTube What Tax Category Is Doordash get the 411 on doordash tax forms and filing for dashers as independent contractors in 2023, including the 1099. Making quarterly estimated tax payments. what doordash 1099 taxes should you pay? Your profit is what you move over to your doordash income tax return as. tracking your business income and expenses. subtract expenses from income to. What Tax Category Is Doordash.

From www.youtube.com

Doordash How to File Tax YouTube What Tax Category Is Doordash tracking your business income and expenses. get the 411 on doordash tax forms and filing for dashers as independent contractors in 2023, including the 1099. Let’s look at each of these responsibilities in more. Making quarterly estimated tax payments. Your profit is what you move over to your doordash income tax return as. Schedule c is the form. What Tax Category Is Doordash.

From www.youtube.com

How to Get TAX FORM from DoorDash, Grubhub & Uber Eats Driver Taxes What Tax Category Is Doordash Making quarterly estimated tax payments. Let’s look at each of these responsibilities in more. There are two main tax categories that you’re liable to pay as a. what doordash 1099 taxes should you pay? subtract expenses from income to determine profit (line 31). Your profit is what you move over to your doordash income tax return as. . What Tax Category Is Doordash.

From taxleopard.com.au

TaxLeopard Tax App for Door Dash Drivers What Tax Category Is Doordash even more important: Schedule c is the form that lets you write off your business expenses and doordash mileage or actual expenses even if you. tracking your business income and expenses. subtract expenses from income to determine profit (line 31). get the 411 on doordash tax forms and filing for dashers as independent contractors in 2023,. What Tax Category Is Doordash.

From entrecourier.com

Best Doordash Tax Deductions and WriteOffs by Category (2023) What Tax Category Is Doordash Schedule c is the form that lets you write off your business expenses and doordash mileage or actual expenses even if you. Your profit is what you move over to your doordash income tax return as. what doordash 1099 taxes should you pay? even more important: tracking your business income and expenses. There are two main tax. What Tax Category Is Doordash.

From www.pinterest.com

A complete guide to Doordash taxes, learn how to get your tax form and What Tax Category Is Doordash even more important: Making quarterly estimated tax payments. There are two main tax categories that you’re liable to pay as a. subtract expenses from income to determine profit (line 31). Schedule c is the form that lets you write off your business expenses and doordash mileage or actual expenses even if you. Your profit is what you move. What Tax Category Is Doordash.

From millennialmoneyman.com

DoorDash Taxes Made Easy (2024 Tax Guide) What Tax Category Is Doordash even more important: Let’s look at each of these responsibilities in more. Making quarterly estimated tax payments. There are two main tax categories that you’re liable to pay as a. Schedule c is the form that lets you write off your business expenses and doordash mileage or actual expenses even if you. subtract expenses from income to determine. What Tax Category Is Doordash.

From support.stripe.com

Guide to 1099 tax forms for DoorDash Dashers Stripe Help & Support What Tax Category Is Doordash Your profit is what you move over to your doordash income tax return as. Making quarterly estimated tax payments. what doordash 1099 taxes should you pay? subtract expenses from income to determine profit (line 31). Let’s look at each of these responsibilities in more. even more important: Schedule c is the form that lets you write off. What Tax Category Is Doordash.

From www.howtofire.com

Is DoorDash Worth It After Taxes in 2023? What Tax Category Is Doordash subtract expenses from income to determine profit (line 31). Making quarterly estimated tax payments. Schedule c is the form that lets you write off your business expenses and doordash mileage or actual expenses even if you. what doordash 1099 taxes should you pay? Let’s look at each of these responsibilities in more. even more important: get. What Tax Category Is Doordash.

From entrecourier.com

What You Need to Know About Doordash Taxes A Simple and Practical What Tax Category Is Doordash what doordash 1099 taxes should you pay? get the 411 on doordash tax forms and filing for dashers as independent contractors in 2023, including the 1099. Your profit is what you move over to your doordash income tax return as. tracking your business income and expenses. Let’s look at each of these responsibilities in more. even. What Tax Category Is Doordash.

From apc1040.com

Impuestos DoorDash 1099 NEC ¡Lo que necesita saber! What Tax Category Is Doordash tracking your business income and expenses. get the 411 on doordash tax forms and filing for dashers as independent contractors in 2023, including the 1099. Let’s look at each of these responsibilities in more. subtract expenses from income to determine profit (line 31). even more important: Making quarterly estimated tax payments. what doordash 1099 taxes. What Tax Category Is Doordash.